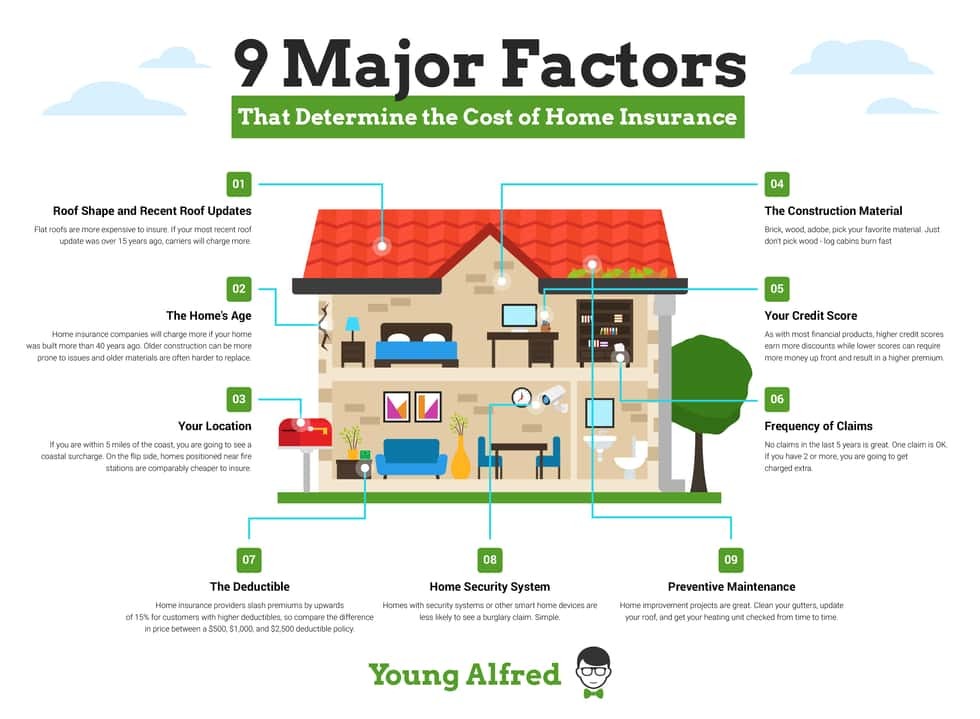

9 Major Factors That Determine the Cost of Home Insurance

Here's a quick look at the nine main factors that determine the cost of your home insurance:

- Roof Shape and Recent Roof Updates

A significant factor driving your home insurance premium is your roof shape and age. Flat roofs are more expensive to insure. If your most recent roof update were over 15 years ago, carriers would charge more today. The age of the roof can also determine your roof claims payout in a claim scenario: Replacement Cost or Actual Cash Value. A roof covering older than 20 years leaves carriers worried they would be paying for a brand new roof next time the wind blows. There are exceptions though, and certain roof materials last longer than your standard asphalt roof:

Roof Material Useful Life Asphalt Shingles 20 years Clay Tile 100 years Slate Shingles 100 years Metal Roof 30-50 years Rubber Roofs 40 years Concrete Tile 100 years Built-up Roofing 15-30 years Membrane 20-25 years Wood Shingles 25-40 years Rolled Roofing 5-8 years - The Home's Age

Home insurance companies will charge more if you have an older house -- more than 40 years old. Older construction can be more prone to issues, and legacy materials are often harder to replace. Around 40 years, the home requires certain core services to be updated: HVAC, plumbing, electrical, and wiring. Responsible homeowners choose to get the systems that need it updated, and others do not. Water boilers are one of the most common sources of water damage claims in basements. You can prevent many of these issues with proper maintenance, but insurance carriers know that not everyone has time for that. For vintage-style homes, find affordable savings by purchasing an HO8 policy for functional replacement cost on your home. You won't get the same materials if you need to replace the floor or wall, but you will save a lot on your home insurance.

- Your Location

If you are within 5 miles of the coast, you are going to see a coastal surcharge, and certain carriers will not even quote coverage. On the flip side, homes positioned near fire stations are comparably cheaper to insure. You can't always choose your home location, but you can improve your chances of finding affordable coverage by using a sophisticated insurance marketplace like mine to find the best price options.

- The Construction Material

Brick, wood, adobe, pick your favorite material. Just don't pick wood - log cabins burn fast and are very hard to insure. In areas prone to high windstorms, having a concrete, masonry, or brick veneer construction will always stand up to wind better than frame construction. In hurricane-prone areas, insurance companies charge more to insure a frame home.

- Your Credit Score

As with most financial products, higher credit scores earn more discounts while lower scores can require more money upfront and result in a higher premium. If you were wondering, getting insurance quotes does not affect your credit score.

- Frequency of Claims

No claims in the last five years are attractive to insurance companies. One claim is OK. If you have two or more, you are going to be charged extra by the insurance company. Certain claim types matter more than others. Water-related claims, theft, and liability claims are high penalty claims and will cause your future premiums to go up or for you to lose coverage altogether. In general, try not to file a claim unless it is 2x-3x your deductible.

- The Deductible

Home insurance providers slash premiums by upwards of 15% for customers with higher deductibles, so compare the difference in price between a $500, $1,000, and $2,500 deductible policy. In coastal regions, there are often separate deductibles for wind, named storm, or hurricane damage.

- Home Security System

Homes with security systems or other smart home devices are less likely to see a burglary claim. Simple enough. You can expect discounts to range from 2% to 10% per year for having an approved security system that protects your home.

- Preventive Maintenance

Home improvement projects are great. Clean your gutters, update your roof, and get your heating unit updated. Carriers often give discounts for recent updates to your Heating, Electrical, or Wiring.

Bonus: High-value items. Homeowners who own valuable items such as expensive jewelry or an art collection will likely have to schedule additional coverage, which is insurance lingo for more coverage, more money. Here are the standard sub-limits for special item categories:

Those nine factors have a tremendous impact on the cost of your home insurance. Happy shopping!

At your service,

Young Alfred